As we weigh the value proposition of installing solar PV’s in affordable multifamily rental properties, it is important for housing organizations to have some understanding about what the costs of solar PV are. This can be difficult because there has been very little transparency about the real costs of solar, especially for installations financed through third-party ownership structures, such as Power Purchase Agreements (PPA), and raises a few cautions for affordable housing providers. Yet, without knowing what the actual costs are, how can we know that the price we are paying is aligned with the net costs of the solar installation? Indeed, how can we know that incentives and tax credits are actually writing down installation costs?

The Department of Energy’s (DOE) Sun Shot Initiative reports that the reported system prices of residential and commercial PV systems have declined 6%–12% per year, on average, from 1998–2014. Within the band on PV installations sized between 50kW to 500kW – the typical scale of multifamily installations – the 2014 cost of PV averaged $3.44 to $3.73 per DC watt.

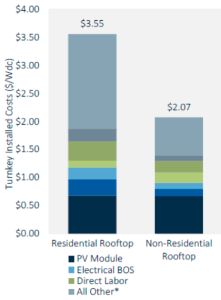

These results correspond with a recent U.S. Solar Market Insight report published by GTM Research and SEIA, which reported the average 2015 pricing for residential rooftop systems landed just above $3.50 per DC watt, with 60 percent of costs from on-site labor, engineering, permitting and other soft costs.[i] Shown below is a cost breakdown from the GTM/SEIA report. Multifamily costs are typically lower than the cost shown for residential rooftop because of economics of scale, and based on the DOE report, the 2015 costs should be somewhere in the range of $2.75 to $3.00/watt, although there is considerable variation across installations, and DOE reports that third-party-ownership-related costs add $0.78/watt to a residential portfolio.[ii]

Average U.S. System Cost Breakdown by Market Segment, Q3 2015

Source: GTM Research / SEIA U.S. Solar Market Insight

Moving ahead in 2016, an important question for affordable housing organizations and low-income renters with a stake in the implementation of AB 693 is how to ensure that solar services are appropriately priced so that we can maximize the number of low-income renters receiving solar installations under the Multifamily Affordable Housing Solar Roofs program enacted by AB 693. This also means ensuring that the program incentives and investment tax benefits available are used to reduce actual solar installation costs.

In this regard, the Lawrence Berkeley Laboratory’s study, Tracking the Sun, offers instructive insights about the solar markets that should not be overlooked by affordable housing advocates. The report found that, “states with higher incentives and/or higher electricity rates may have higher installed prices as a result of value-based pricing.”[1] Value-based pricing refers to a practice used by solar companies to provide PV service agreements based on the value of the solar to the customer, rather than based on the actual costs of the solar system (hard costs, installation costs, and development fees). The presumption by solar companies using this practice is that if the cash flow benefits are large enough, a property will look past the actual installations costs and added project costs paid over the period of the agreement. This practice is very prevalent in solar transactions financed though Third Party Ownership (TPO) structures, such as Power Purchase Agreements (PPA), and raises a few cautions for affordable housing providers.

First, value-based pricing is highly dependent on cash flow projections that quantify the value proposition to the property. This dynamic creates inherent conflicts of interest since it is in the interest of solar companies to report high levels of savings to gain business. To properly assess the financial value (and potential financial risks) to the property, it is very important that the cash flow analysis be accurate and reliable, and that assumptions driving energy savings and costs forecasts for the full period of the solar agreement be fully disclosed. Safeguards to detect vulnerabilities to out-year cash flows – where out-year solar costs increase and energy savings decline – are also needed to avoid putting the property at risk.

Second, value-based pricing imposes added costs for the solar installation that can be significantly greater than what the financed cost of the funding gap (actual solar costs minus rebates and ITC contributions) would be if the owner financed and owned the installation directly. This is especially true where solar agreements use cost escalators to bolster the out-year returns of solar companies and where depreciation benefits are not used to reduce calculations of net project costs. While the value-based approach does provide a benefit to the owner in relieving the organization from having to secure financing to cover the funding gaps for the project and allows properties to realize positive cash flows sooner, the comparative value of this “convenience” to the property should be carefully evaluated. Specifically, owners should explore the benefits of negotiating purchase options, which allow the property owner, not the solar company, to capture and retain the full value of incentives and tax benefits. Compared with leased PV systems, solar systems owned by affordable housing properties result in a lower overall cost for electricity,[2] more cash flow, and greater financial stability. This may argue for deferring solar investments until refinancing or resyndication.

A large part of my work at the California Housing Partnership is to help nonprofit affordable housing owners navigate the complexities of solar project implementation and to incorporate these lessons into our policy advocacy with the agencies that regulate this field. Over the next year we will seek your feedback and through other blogs we will provide regular updates on AB 693 implementation and other related policies and practices.

It is my hope that through our work together we will not only increase access to clean energy opportunities and reduce utility costs for low-income renters, but also help nonprofit housing organizations to take full advantage of unprecedented solar incentives that will be available in the years ahead. In this way, we hope to improve both household budgets of low-income families and the long-term operational stability of the properties in which they live.

– Wayne Waite, Policy Director

____________________

[i] See: http://www.greentechmedia.com/articles/read/US-Solar-PV-System-Prices-Continue-to-Decline-in-Q3-2015.

[ii] David Feldman, Barry Friedman, and Robert Margolis, Financing, Overhead, and Profit: An In-Depth Discussion of Costs Associated with Third-Party Financing of Residential and Commercial Photovoltaic Systems, October, 2013. National Renewable Energy Laboratory. Technical ReportNREL/TP-6A20-60401. http://www.nrel.gov/docs/fy14osti/60401.pdf

[1] Galen Barbose, Samantha Weaver, Naïm Darghouth, Tracking the Sun VII: An Historical Summary of the Installed Price of Photovoltaics in the United States from 1998 to 2013, Lawrence Berkeley National Laboratory, September 2014. http://eetd.lbl.gov/sites/all/files/tracking_the_sun_vii_report.pdf

[2] Based on CHPC analysis we believe this savings could be $0.04 to $0.08 per kWh.