By the California Housing Partnership

The California Housing Partnership recently analyzed data from the first three years of program awards of CalHFA’s Mixed Income Program (MIP) to assess its impact to date and compare it with other longstanding affordable housing finance programs on such factors as development type and location, levels of affordability, and costs.

The California Housing Partnership recently analyzed data from the first three years of program awards of CalHFA’s Mixed Income Program (MIP) to assess its impact to date and compare it with other longstanding affordable housing finance programs on such factors as development type and location, levels of affordability, and costs.MIP was created by CalHFA in 2017 to incentivize the construction of new rental housing developments affordable for a mix of incomes between 30% and 120% of the area median income (AMI). As difficulties in financing new affordable homes for households above 80% of AMI without Low Income Housing Tax Credits (LIHTC) became more clear, CalHFA focused more on assisting developers serving households up to 80% of AMI and required greater percentages of homes affordable to very low- (50% of AMI) and extremely low-income families (30% of AMI) to satisfy LIHTC requirements and the newly-competitive tax exempt bond program administered by the California Debt Limit Allocation Committee.

Key findings from the MIP Outcomes Analysis for program years 2019-2021:

- MIP-awarded developments serve households that have an average AMI of 59%, whereas non-MIP developments participating in the bond and 4% LIHTC programs serve households with an average AMI of 47%. 9% LIHTC-awarded developments financed without bonds serve households with an average AMI of 45%.

- MIP-financed affordable homes tend to be less expensive than 4% LIHTC developments but more expensive than 9% LIHTC developments.

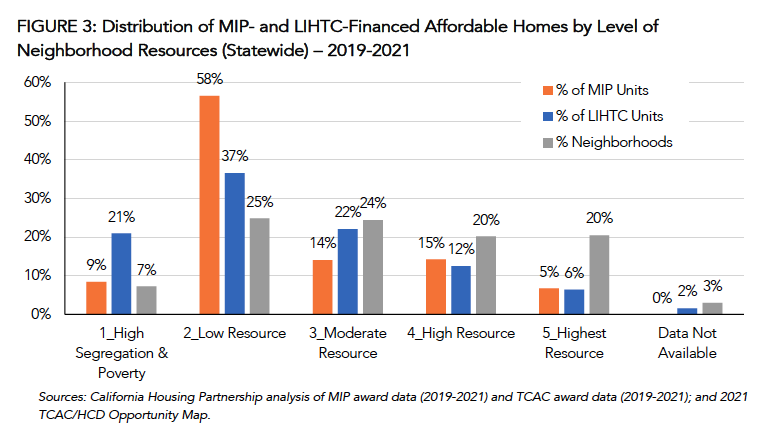

- Most MIP-awarded developments are located in Lower Resource Areas as defined by the state Opportunity Maps to Affirmatively Further Fair Housing (AFFH). MIP-awarded developments are located in High Resource areas marginally more often than their LIHTC-financed counterparts.

- 75% of MIP-awarded developments are created by for-profit developers. In comparison, approximately 68% of LIHTC developments have been created by for-profit developers.

Please read our full MIP Outcomes Analysis Memo for details.

To further discuss this memo’s findings, join the conversation on social media with these hashtags: #MIP #mixedincome #affordablehomes

Learn more by visiting the Publications section of our website.