Launching our inaugural microblog! Throughout the year, the Partnership’s Research team will spotlight various key points from our recent research to provide you with extra perspectives on the issues surrounding housing affordability in California and the research and data tools being developed by our team to better understand the challenges + how they can be overcome.

As more businesses, schools, and offices return to in-person activity with the lifting of COVID-19 mask mandates in the Bay Area and other parts of California, it is important to look at the ongoing housing unaffordability crisis throughout the state and how the pandemic has affected asking rents. A recent article from the San Francisco Chronicle notes that while rents increased in 2021, they remain below pre-pandemic levels, and cites data from online rental service, Apartment List, looking specifically at monthly changes in median rents for one-bedroom apartments in cities throughout the Bay Area.[1] A few months prior, the California Housing Partnership conducted a similar analysis that found that, on average, rents did increase at or above pre-pandemic levels across many counties in California, including in the Bay Area. Further, rental increases were not consistent across building types, as older housing types were harder hit.

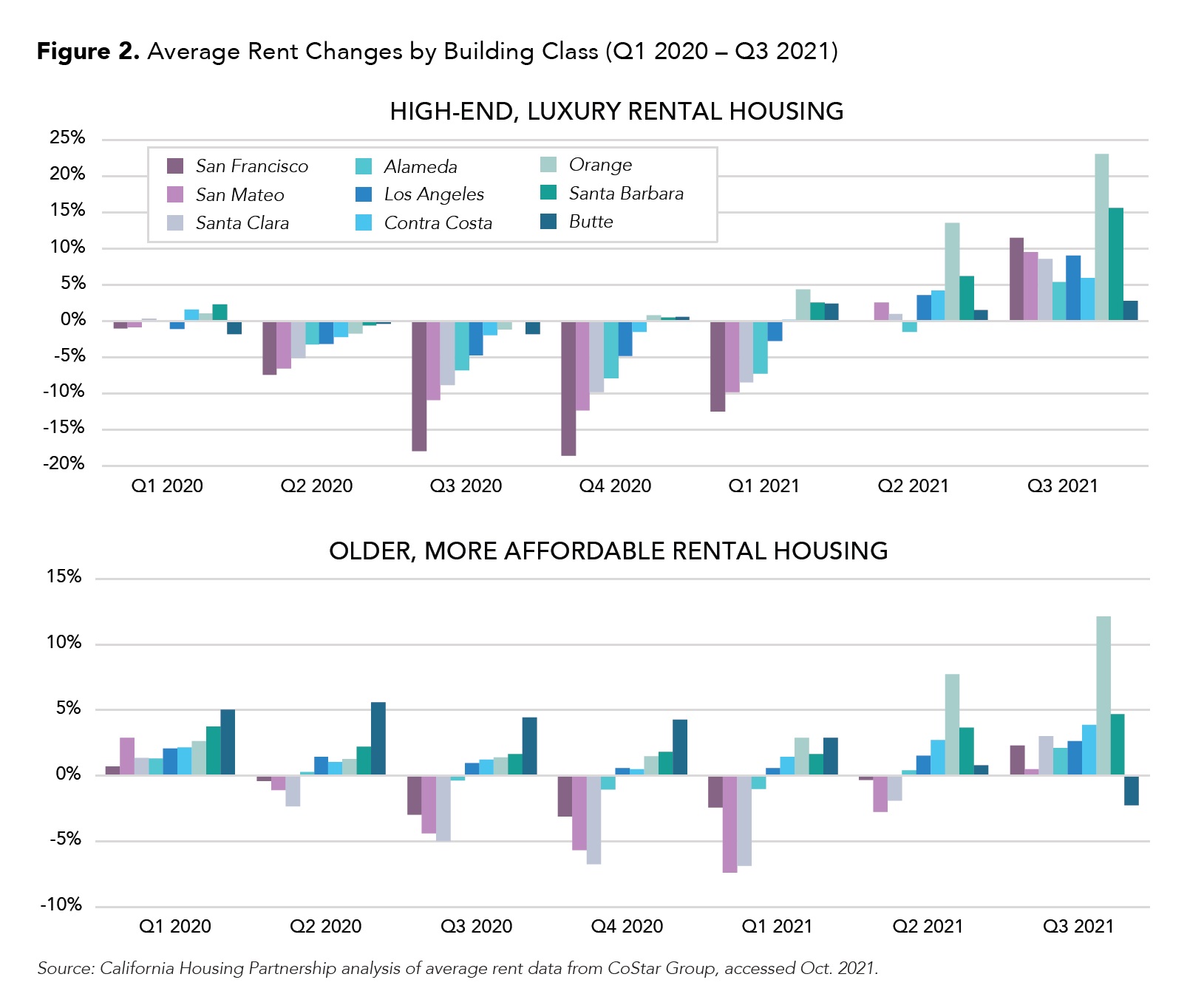

By disaggregating by building class[2], the Partnership found:

- Statewide, in older, more affordable developments, average rents increased in all quarters during the pandemic’s first 18 months, from March 2020 to September 2021.

- Rent decreases that did occur were more often and at a greater magnitude in high-end luxury housing than among older and more affordable homes throughout the state.

- Several counties that saw rent decreases in their luxury housing saw average rents increase in their older, more affordable housing stock throughout 2020 and into 2021.

- As of the third quarter of 2021, rents in the older, more affordable rental stock were at or above pre-pandemic rates in all Bay Area counties except for Santa Clara and San Mateo.

Since the multifamily rental market in any jurisdiction or region does not operate as a monolith, trends present in the higher end of the market may be experienced in a different way for other renters. In nearly all areas of the state, the economic relief and mobility residents of luxury rental homes experienced during the pandemic were not shared by residents of older and more affordable rental homes, compounding the already disparate levels of risk, exposure, and wage loss experienced by working class renter families over the last two years. Read our full report: https://chpc.net/resources/policy-brief-2021-covid-rent-increases-ca/.

As jurisdictions around the state continue to take steps towards reopening, particular attention should be paid to the housing market’s effects on the mobility and housing fragility of California’s lower-income renter households. Tracking the rebound of multifamily rents in the coming months and years will allow us to look back on the extent to which the COVID-19 pandemic prolonged, or even escalated, existing housing inequities and to work proactively – through the Roadmap Home 2030 and other measures – to increase housing stability and security for all Californians.

#microblog

[1] The Apartment List data used does not disaggregate by qualitative differences in building type, e.g., luxury vs. older properties.

[2] Our analysis used data from CoStar on each development’s building class (A, B, C, or F) as a proxy for housing quality. Building class assignments depend on a variety of building characteristics, such as age, amenities, location, design, and building finishes and materials. Developments with an A rating are high-end, luxury rental homes and those rated C or F tend to be older, more affordable rental homes.