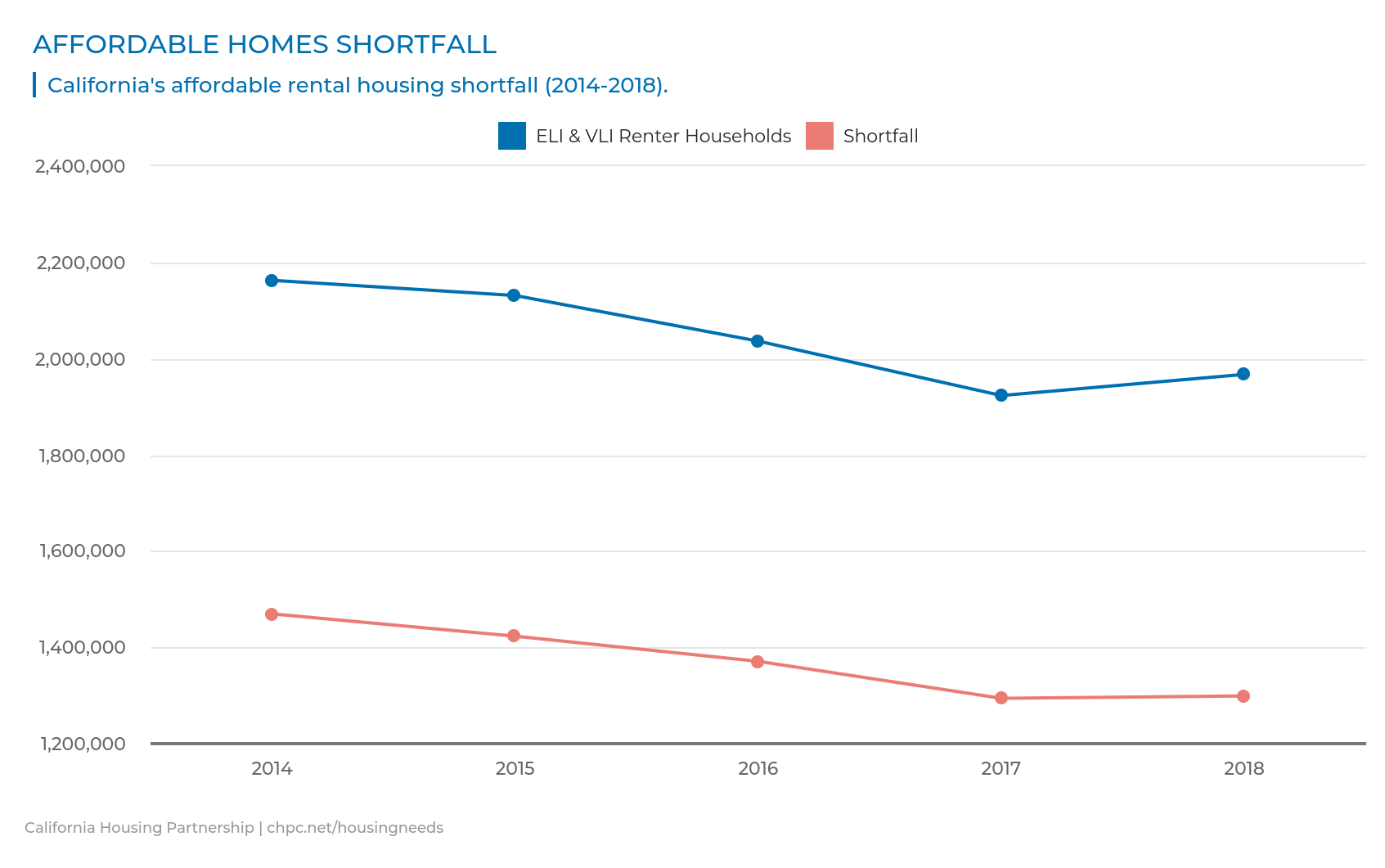

The California Housing Partnership’s new Housing Needs Dashboard reveals not only that 1.3 million low-income renter households in California do not have access to an affordable home, but also that this situation has persisted for years.

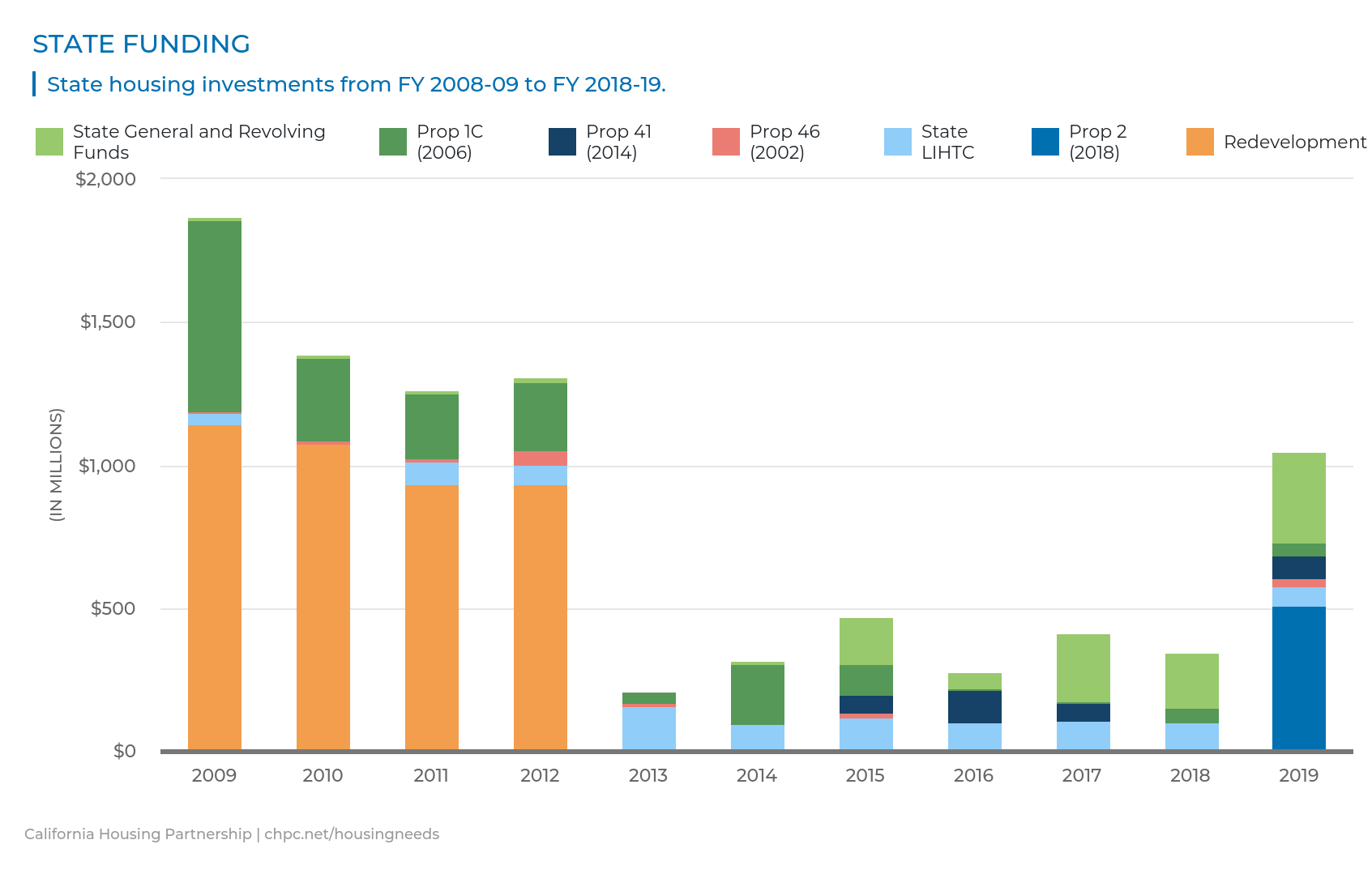

My 22 years of experience working in affordable housing has made clear to me that the private market is unable to produce homes for these households, since below-market rate rents do not cover the costs of construction. The development of affordable homes for lower-income families requires state investment. The Dashboard also shows that in the six years (2013-2018) after the demise of redevelopment agencies and their requirement to dedicate 20% of revenues to affordable housing, state investments in affordable housing plummeted from an annual average of $1.3 billion to less than $500 million, and dipped as low as $200 million per year.

The Dashboard also shows that in the six years (2013-2018) after the demise of redevelopment agencies and their requirement to dedicate 20% of revenues to affordable housing, state investments in affordable housing plummeted from an annual average of $1.3 billion to less than $500 million, and dipped as low as $200 million per year.  Thanks to the efforts of state leaders — beginning in 2017 with the passage of SB 2 (Atkins) dedicating $250 million in annual revenues for affordable housing, and continuing with the passage of the Proposition 1 and 2 housing bonds in 2018 authorizing $5 billion in new funding and Governor Newsom’s support for an additional $500 million in state low-income housing tax credits in 2019 and 2020 — the state began to reverse this concerning trend in 2019.[1]

Thanks to the efforts of state leaders — beginning in 2017 with the passage of SB 2 (Atkins) dedicating $250 million in annual revenues for affordable housing, and continuing with the passage of the Proposition 1 and 2 housing bonds in 2018 authorizing $5 billion in new funding and Governor Newsom’s support for an additional $500 million in state low-income housing tax credits in 2019 and 2020 — the state began to reverse this concerning trend in 2019.[1]

However, without further state leadership this progress will erode quickly since the state tax credits are not guaranteed beyond 2021 and the bond funds will likely be exhausted by the end of 2022. In order to make significant progress in meeting today’s daunting housing needs, long-term funding commitments are needed.

The housing shortage is a multi-year crisis that demands foresight and strategic planning. The Partnership calls on the Governor and Legislature to make permanent the additional state low-income housing tax credits and to place a $10 billion bond on the 2022 ballot in order to more fully fund the state’s critical affordable housing finance programs.

As the coronavirus pandemic and the national discussion on systemic racism have highlighted like never before, an affordable home is much more than just a roof over one’s head — it is the foundation of a family’s health, welfare, and economic opportunity. I have never seen a more urgent time for the state to make the significant and ongoing financial commitment necessary to address the housing needs of California’s lower-income families.

Please visit the Partnership’s Housing Needs Dashboard to discover and compare housing data for every California county and the state overall, including:

Please visit the Partnership’s Housing Needs Dashboard to discover and compare housing data for every California county and the state overall, including:- Affordable housing need versus supply

- Housing market condition indicators

- Federal and state affordable housing funding levels

- Multifamily housing production and preservation trends