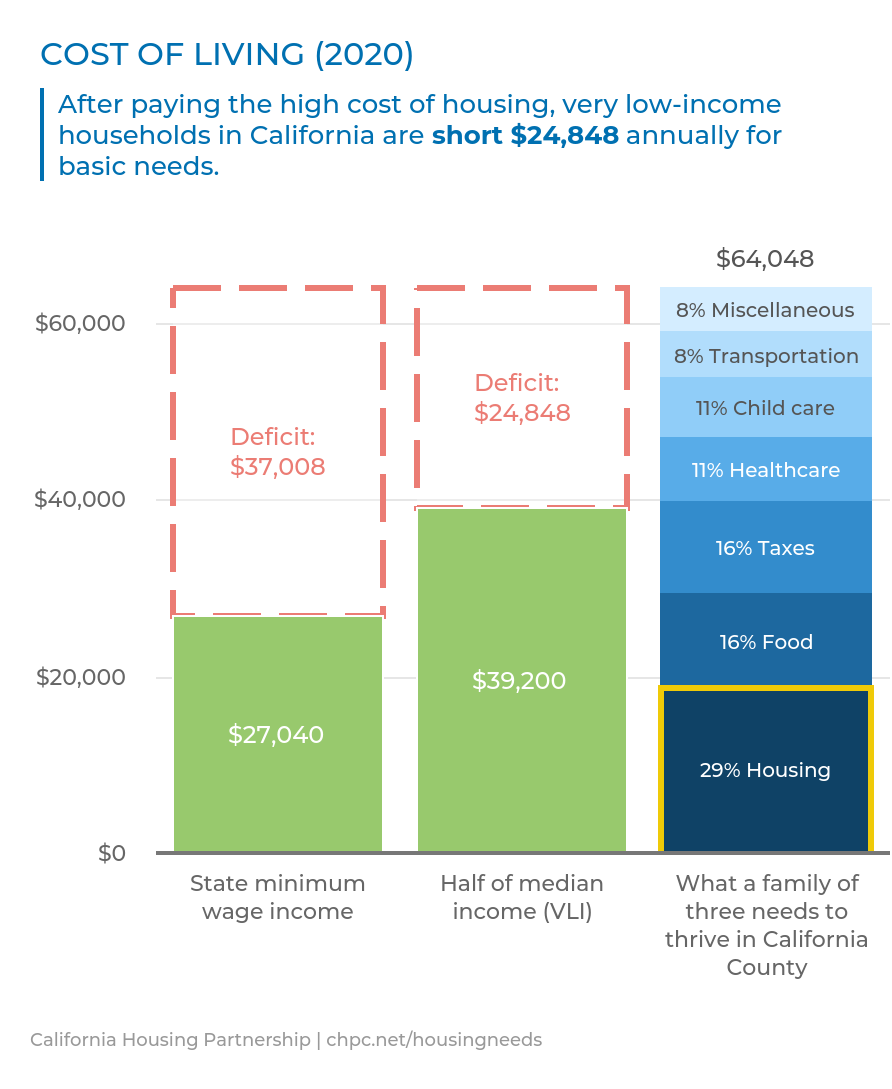

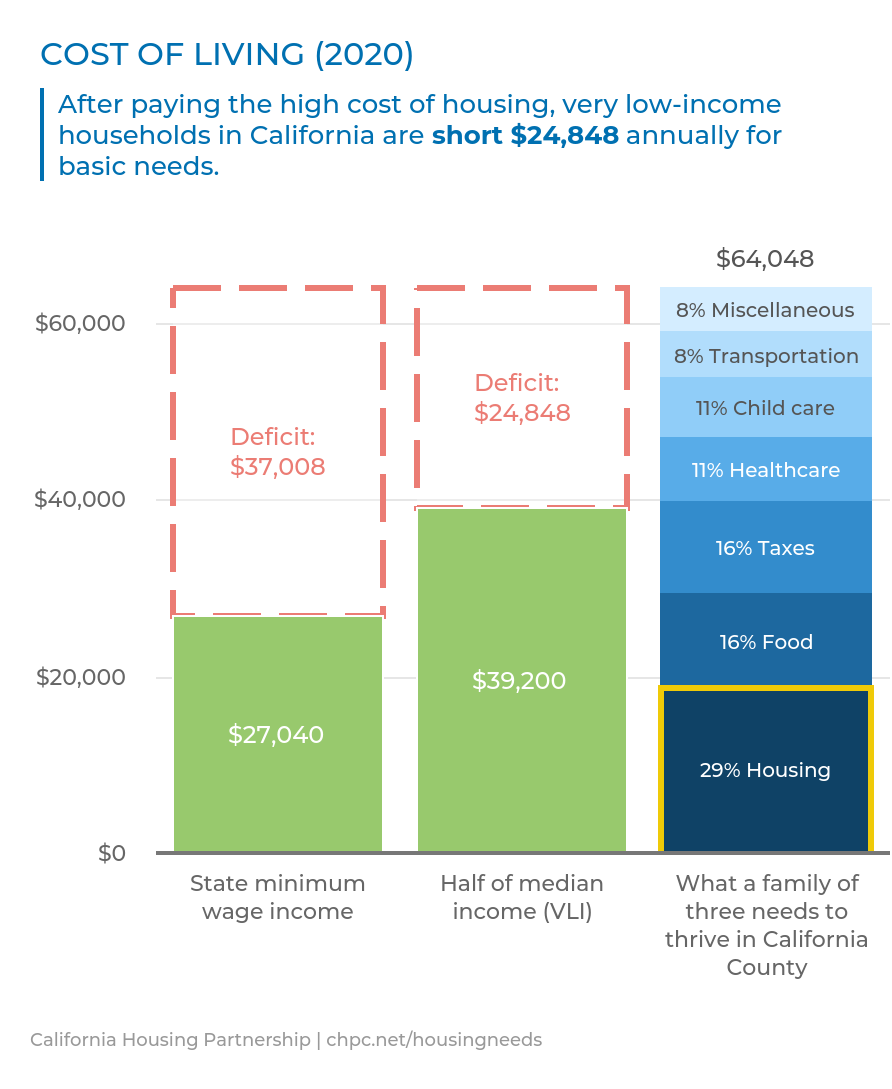

The data powering this indicator is from the United Ways of California’s

Real Cost Measure analysis, which asks how much Californians need to meet their most basic needs.

[ii] As shown in the Dashboard graphics below, a family of three in California needs to make approximately $64,000 per year to meet their basic needs, meaning workers living on minimum wages are short more than $3,000 each month ($37,000 per year) on average throughout the state.

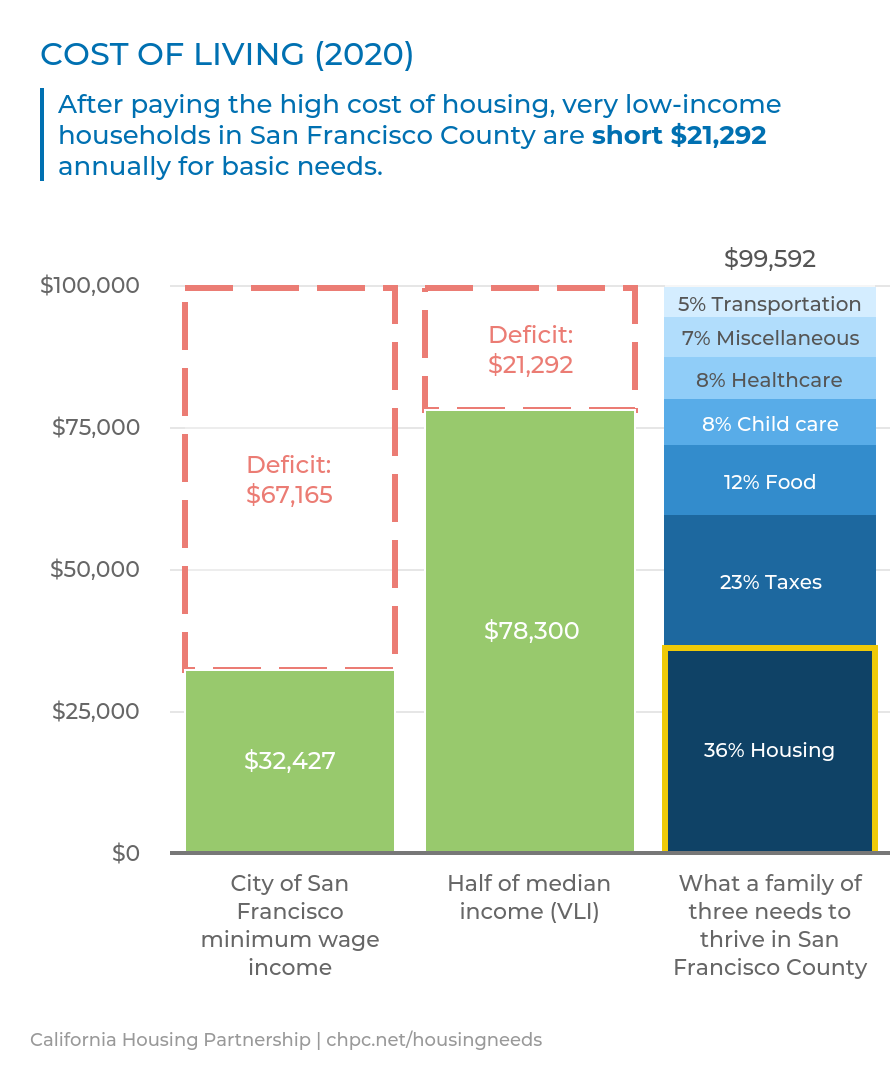

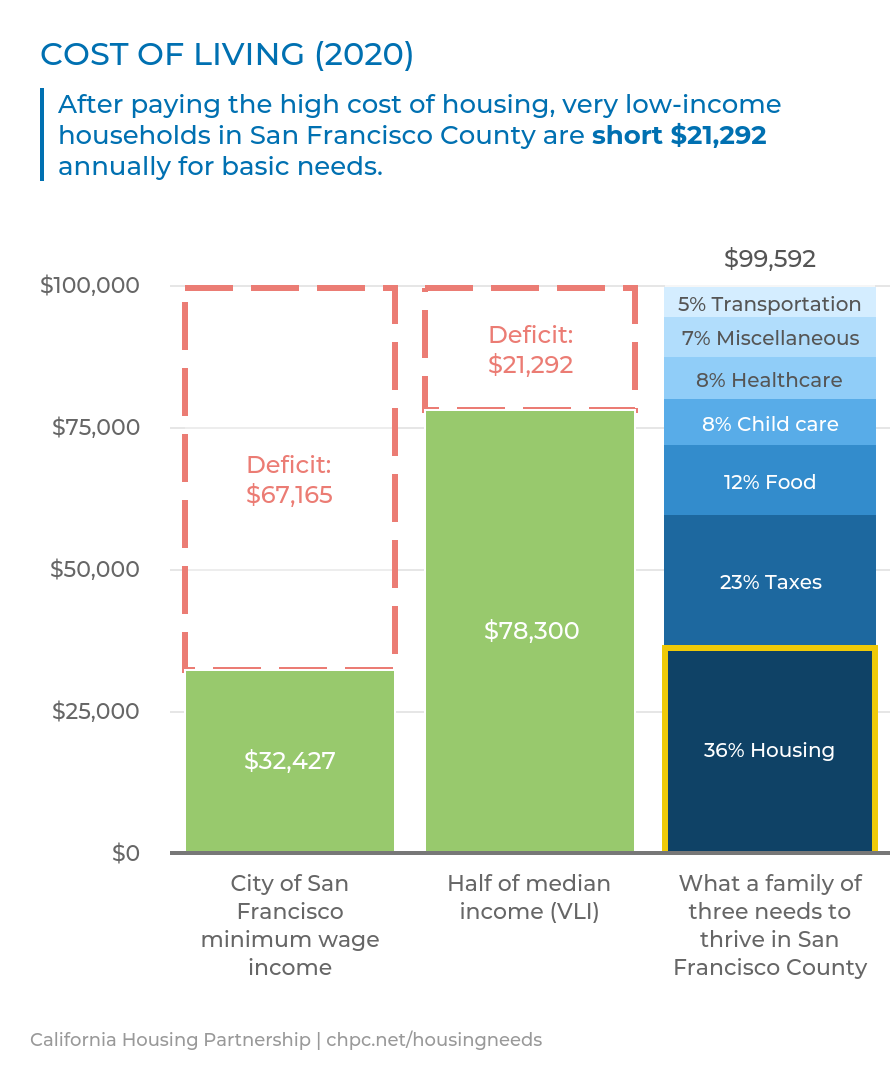

In some of the state’s costliest coastal markets, this gap between income and basic needs is even wider. For example, the cost of living is closer to $100,000 for households living in San Francisco, resulting in an estimated household budget shortfall of more than $5,500 per month ($67,000 per year) for households making minimum wage. San Francisco renters earning half of the area median income fall short by almost $2,000 each month ($21,000 per year).

| STATEWIDE |

SAN FRANCISCO COUNTY |

|

|

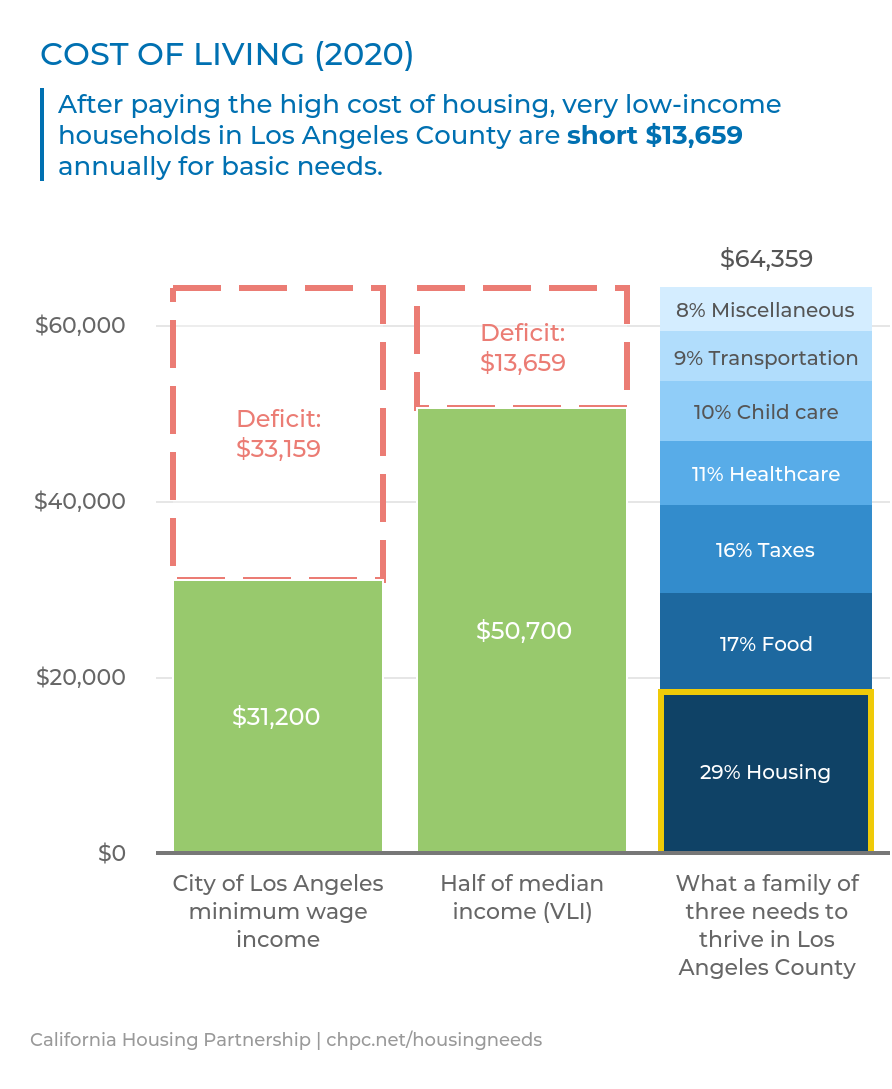

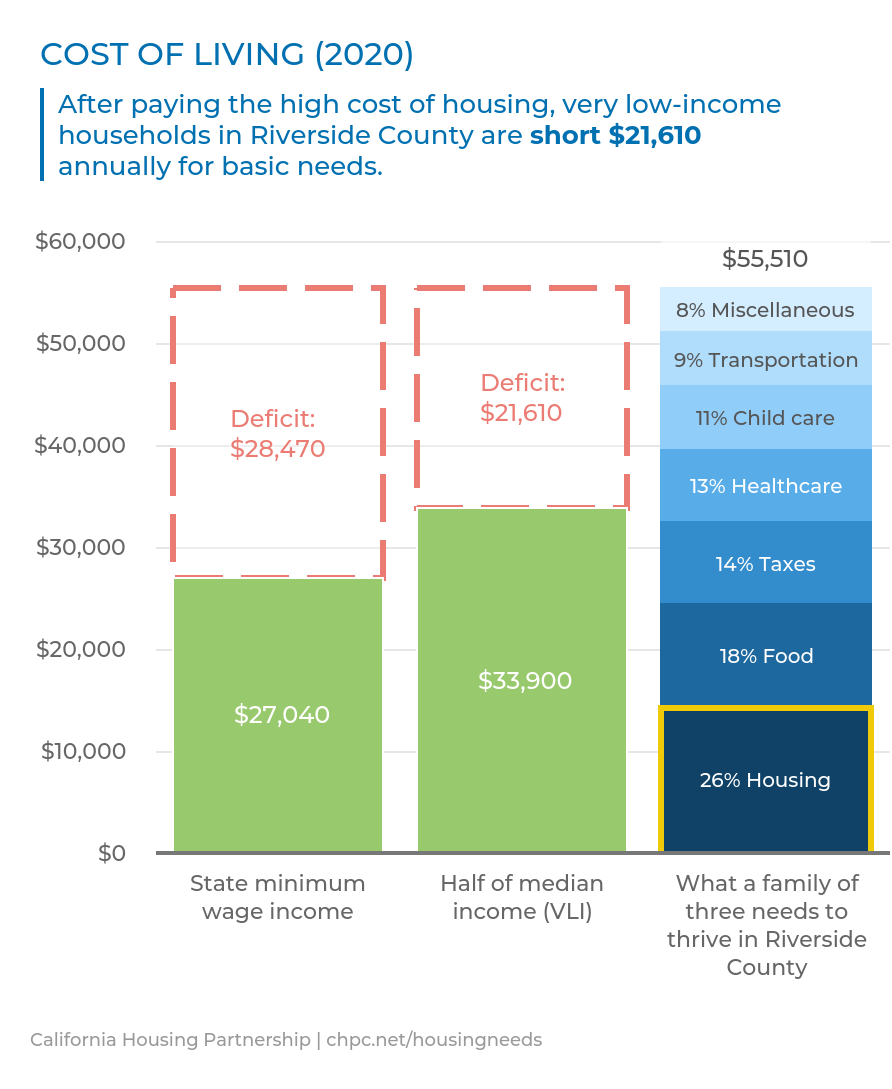

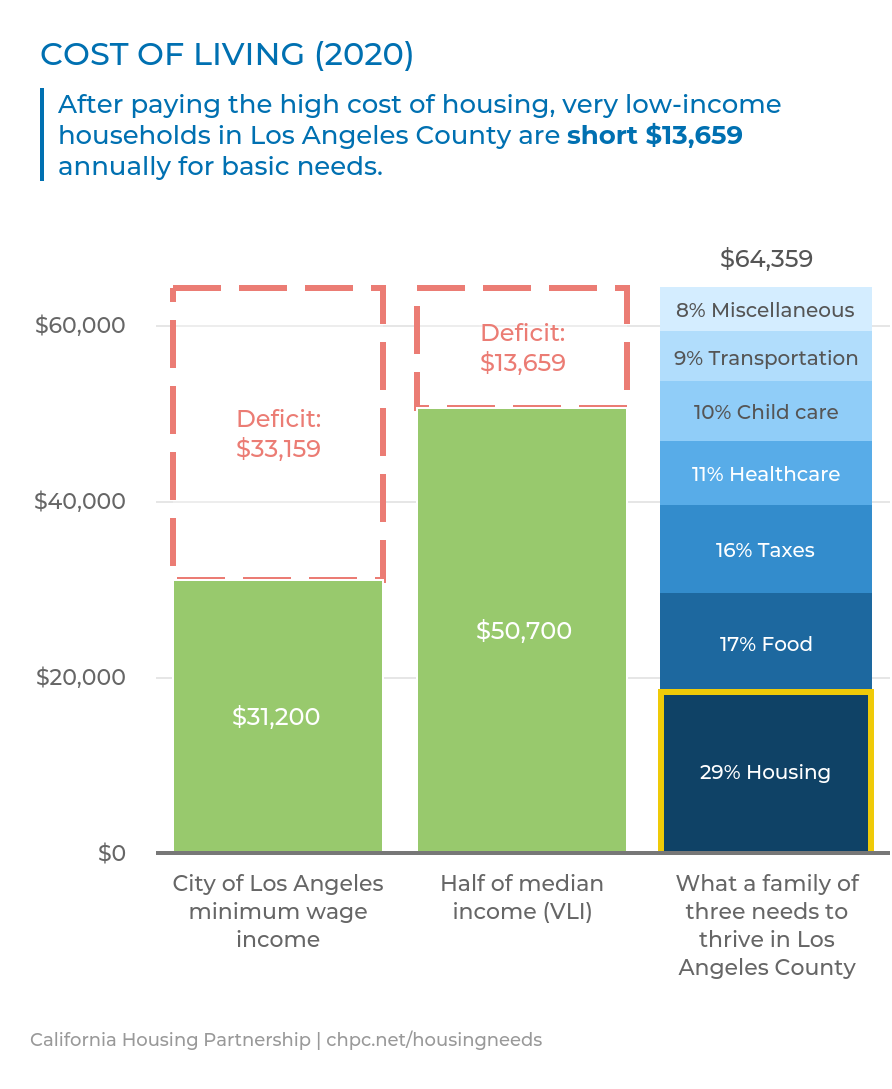

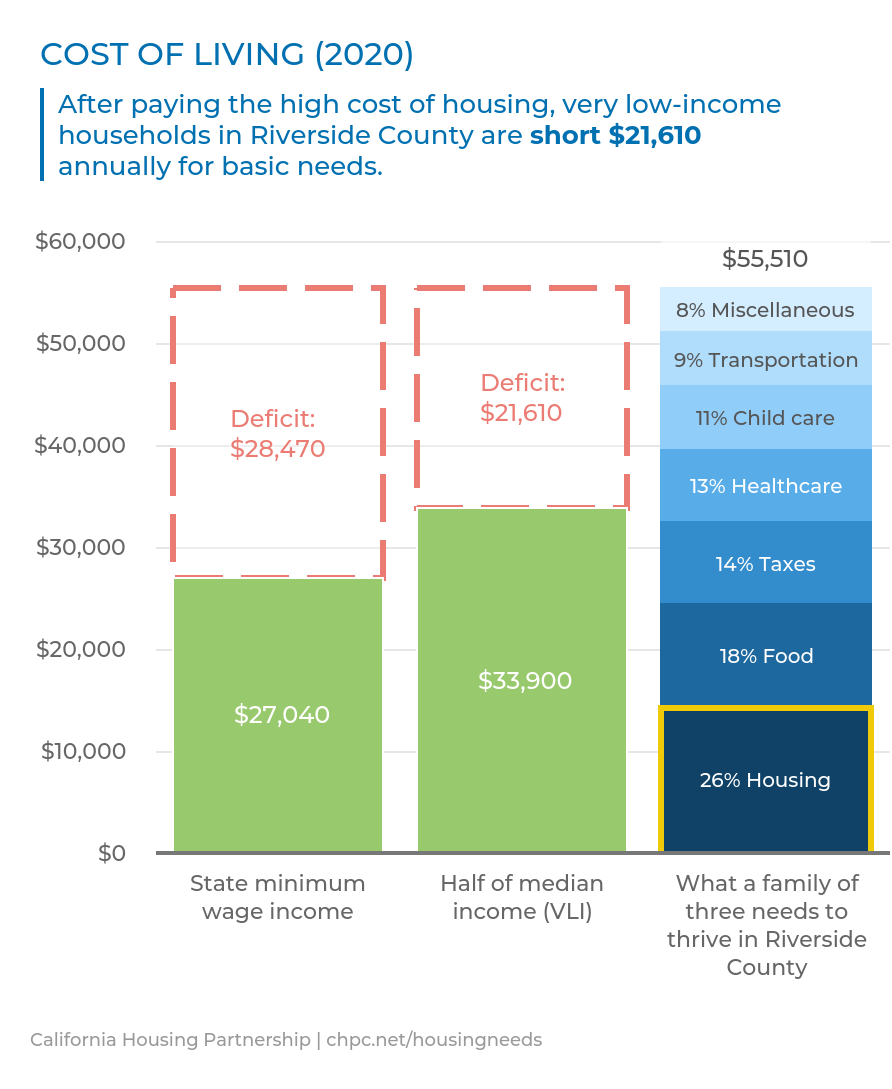

Renter households earning minimum wage in Los Angeles County are short more than $2,700 per month or $33,000 per year while renters earning half of median income in Riverside County are short $1,800 per month or $21,000 per year.

| LOS ANGELES COUNTY |

RIVERSIDE COUNTY |

|

|

While the graphics above focus on major metropolitan areas, the story is the same throughout the state: in every one of California’s 58 counties, renters with lower incomes face a significant gap between the local cost of living and their incomes. This persistent deficit is driven largely by the fact that growth in rents has consistently outpaced growth in California renter incomes. The California Housing Partnership’s

2020 Affordable Housing Needs Report shows that since 2000, California’s median rent has increased by 40% while median renter income increased a mere 8%.

[iii] This extreme disparity has resulted in a $1,273 decline in annual purchasing power for renter households.

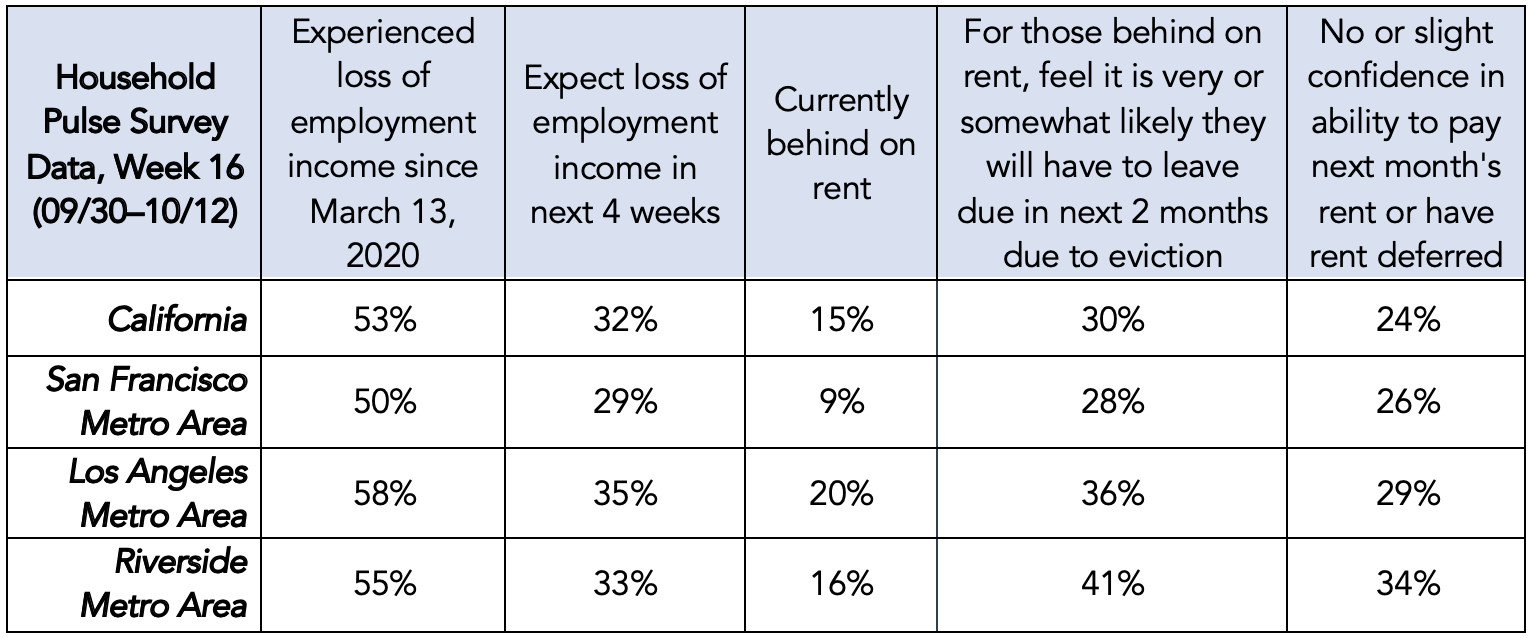

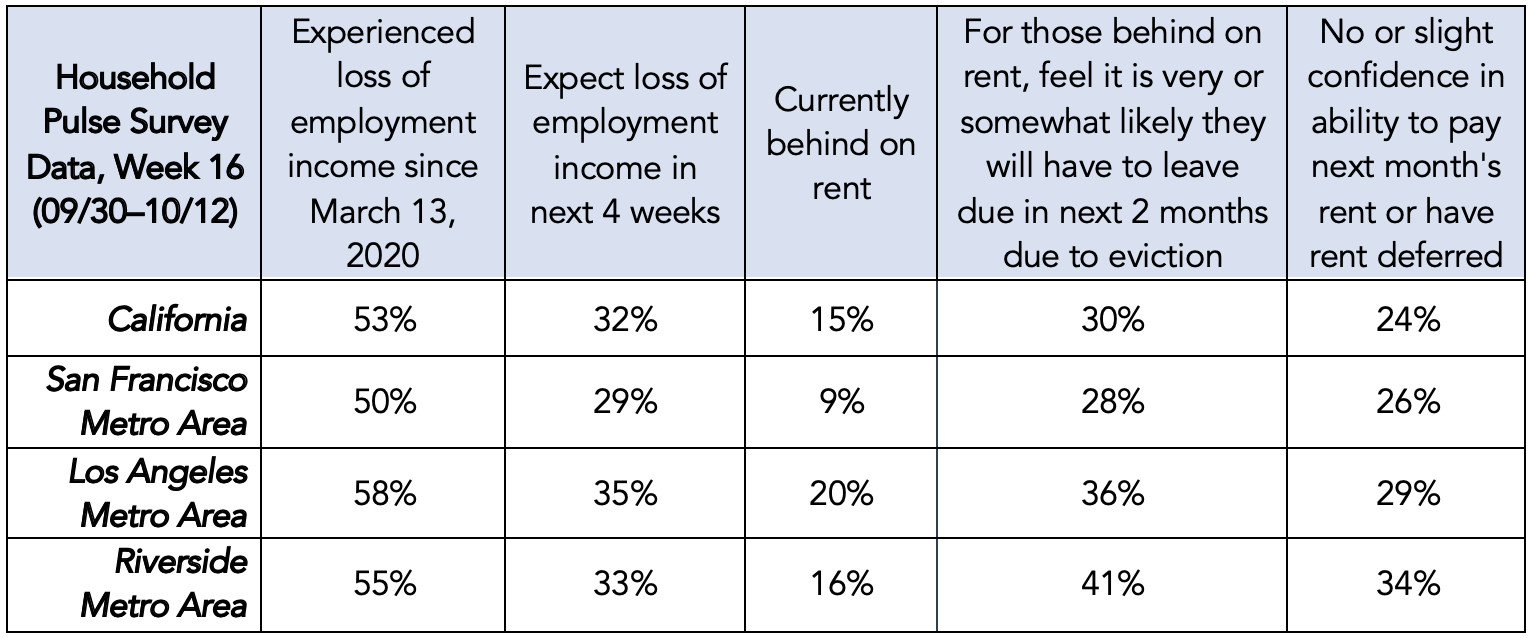

With the US now nearly eight months into the coronavirus pandemic, the economic landscape has shifted drastically, and the financial situation for these households has worsened. Among the most striking figures from the Household Pulse Survey results are those related to loss of income and housing instability: statewide, 53% of adults reported someone in their household experiencing a loss of income since shelter in place began in March 2020, including 58% in the LA region and 50% in the Bay Area. Further, one in three Californians expected to lose employment income in the next four weeks. Additionally, 15% of respondents in renter households statewide reported being behind on rent — with 30% of them anticipating the likelihood of facing an eviction in the next two months as “somewhat” or “very likely.”

Source: California Housing Partnership analysis of Household Pulse Survey data, U.S. Census Bureau, Phase 2, September 30-October 12.

Source: California Housing Partnership analysis of Household Pulse Survey data, U.S. Census Bureau, Phase 2, September 30-October 12.

The above data from the Census Bureau’s pandemic-initiated Household Pulse Survey is a clear harbinger of what we expect to see in the next update of the cost of living data in the Dashboard: a loss of income among most low-income households that far surpasses the aid provided by Congress through the CARES Act. Unless Congress intervenes before the end of the year, by early next year, we expect to see many more low-income California families becoming severely cost-burdened, homeless or being displaced from their communities.

All of which underscores that an affordable home is fundamental to a person’s or family’s health and safety, and that housing justice is about more than just shelter, it is a matter of public health as well.

If you are interested in learning more about the Partnership’s other COVID-19 research, federal and state policy recommendations, and webinar briefings, visit:

chpc.net/covid19.

Source: California Housing Partnership analysis of Household Pulse Survey data, U.S. Census Bureau, Phase 2, September 30-October 12.

Source: California Housing Partnership analysis of Household Pulse Survey data, U.S. Census Bureau, Phase 2, September 30-October 12.