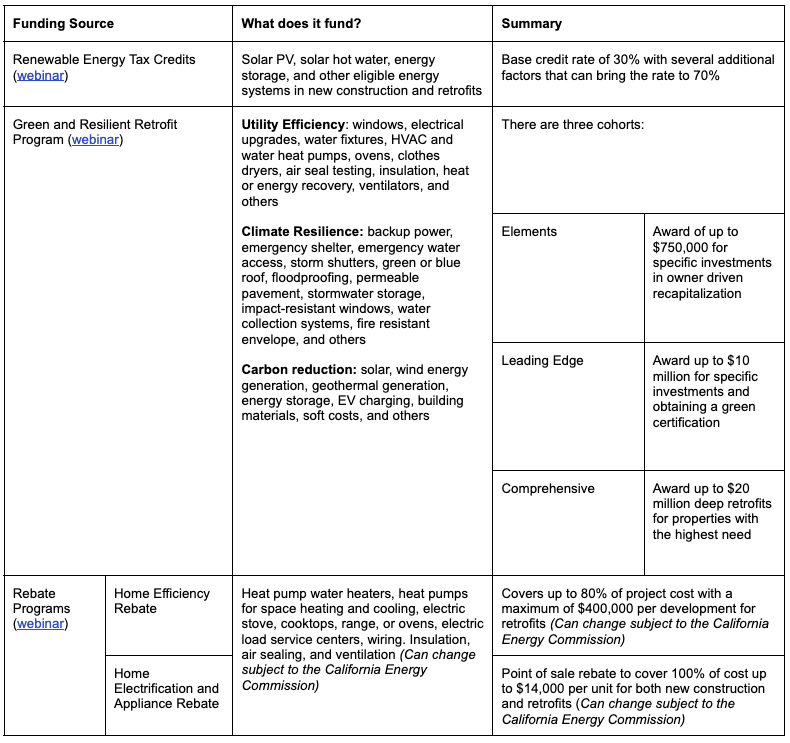

Interested in a new funding source to support climate-friendly affordable housing? The 2022 federal Inflation Reduction Act (IRA) offers potentially billions of dollars toward decarbonization affordable housing in California. Unfortunately, the regulations and timing are different for each program which makes accessing IRA resources challenging. The California Housing Partnership held a series of workshops to provide information about the resources in January and February 2024. The table below is a general summary of three of the main IRA programs potentially accessible to affordable housing providers with links to briefs about each program and to the recordings of the Partnership’s workshop series.

The following is a more detailed summary of each IRA program available to affordable housing providers in California including links to the respective federal agency website and related resources:

The Green and Resilient Retrofit Program (GRRP): Previewing A New Resource For Decarbonizing Affordable Housing

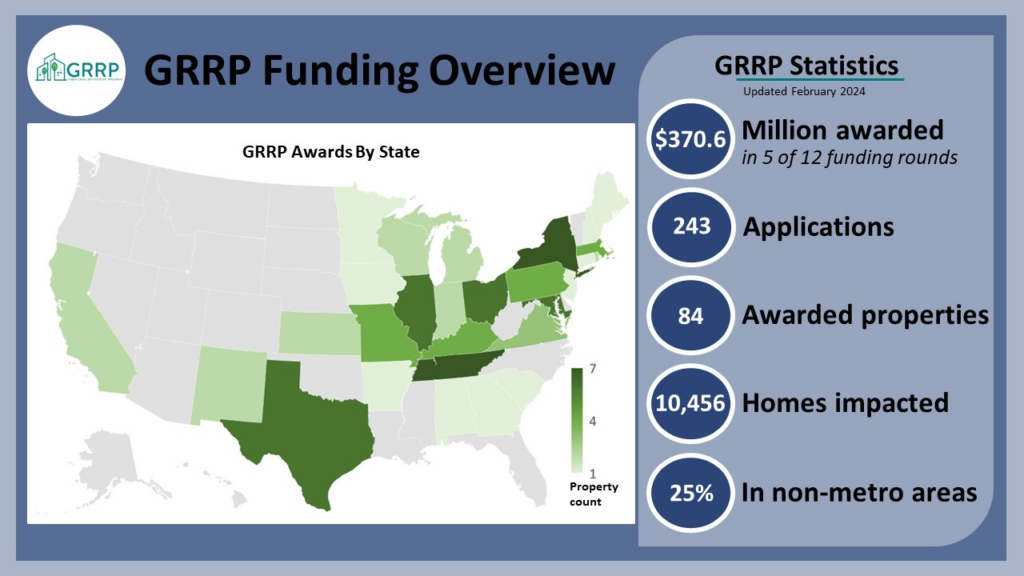

At a time when California is more focused than ever on reducing Greenhouse Gas (GHG) emissions to meet state goals and resiliency concerns are paramount, the Green and Resilient Retrofit Program (GRRP) stands out as a significant opportunity for affordable housing providers. This comprehensive program, administered by the Department of Housing and Urban Development (HUD), offers substantial grants and loan authority to eligible property owners or purchasers.

HUD Notice 2023-05 introduced the GRRP and allocated an impressive $837.5 million for grants and up to $4 billion in loan authority. As of February 2024, California has received two awards totalling $5,451,635. The program’s website, hud.gov/GRRP, provides valuable resources such as FAQs, fact sheets, and benchmarking information. Additionally, HUD conducts GRRP Office Hours every Wednesday at 3:00 PM EST, offering further guidance and support to applicants.

GRRP focuses on funding retrofits of existing HUD-assisted affordable housing that enhance energy efficiency, climate resilience and indoor air quality. Eligible expenses and activities include carbon emission reduction, enhanced energy and water efficiency, improved indoor air quality, and building electrification, among others.

Certain new construction developments are also eligible for GRRP financing, if the applicant has an eligible HUD Multifamily assistance contract. Applicants should use the existing HUD-assisted project for data and scoring needed for the applications (e.g. MBEST). Other HUD approvals for the new construction elements may be required.

The program offers three distinct award paths or “cohorts,” catering to properties at different levels of need and varying owner expertise. The Elements Cohort offers up to $750K per property to target energy efficiency and climate resilience in owner-driven recapitalization transactions. The Leading Edge Cohort provides up to $10 million per property to encourage more ambitious decarbonization efforts and pursuit of green certification. The Comprehensive Cohort focuses on deep retrofits for properties with the highest need, prioritizing energy consumption and climate risk considerations. This cohort offers the largest awards of up to $20 million per property. In general, the larger the award available for each cohort, the greater the involvement from HUD.

The application process involves several steps including reviewing the Notice of Funding Opportunity (NOFO), downloading the cohort-specific Excel application form, registering for a Unique Entity Identifier (UEI) number on sam.gov, completing the application form and submitting via grants.gov before the deadline. Each cohort accepts applications quarterly, providing multiple opportunities for interested parties to apply.

The program emphasizes extended project affordability commitments. Affordability restrictions range from 15 to 25 years. Recipients must adhere to various requirements depending on the cohort. These measures can include resident notification, disaster preparedness planning, utility benchmarking, and compliance with regulatory agreements. Applicants are also expected to participate in federal initiatives including Justice 40, Affirmatively Furthering Fair Housing, and the Davis–Bacon Act.

GRRP offers two award types: grants and loans. While not strictly competitive, awards can become competitive if more funding is requested for a cohort round than is available. However, a qualified application will roll over from one round to another. For this reason it is recommended that developers wait to submit their strongest possible application rather than rush an incomplete application to meet a round deadline. Selection in GRRP applications is influenced by factors such as regional set-asides, energy efficiency, and climate risk. Other considerations for applicants include tenant engagement, energy consumption reduction targets, and compliance with HUD regulations.

California affordable housing providers are in a unique position with regards to GRRP because these financial incentives can be co-leveraged with the California Energy Commission’s Building Initiative for Low-Emissions Design (BUILD). BUILD offers up to 300 hours of free technical assistance for developing all-electric affordable housing. BUILD technical assistance can help maximize the effectiveness of electrification and energy efficiency measures adopted as part of GRRP participation. For more information on accessing BUILD TA services, contact Ian Sharples (isharples@chpc.net).

Note: The information provided in this blog post is based on the GRRP guidelines and resources available as of March 2024. Applicants are encouraged to refer to the official HUD website for the most up-to-date information and application procedures. For additional information, check out the recording Partnership’s recent webinar Accessing Funding For Affordable Housing Through The Green and Resilient Retrofit Program (GRRP).

Inflation Reduction Act Rebate Programs and the Equitable Building Decarbonization Program

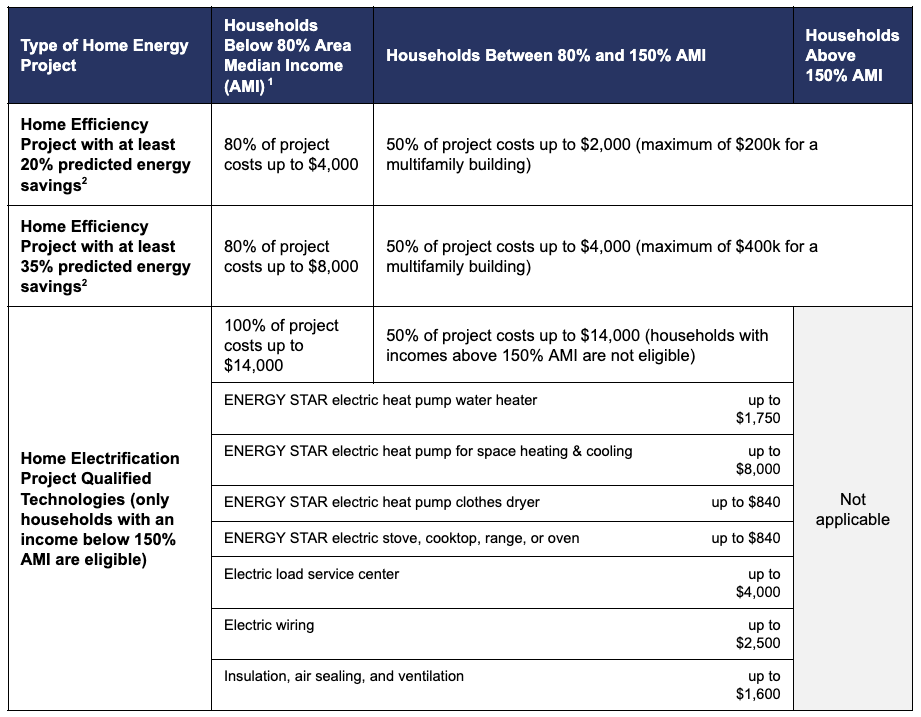

The California Energy Commission (CEC) will be administering two rebate programs that will offer up to $592 million for California: the Home Efficiency Rebate (HER) and the Home Electrification and Appliance Rebate (HEAR). Additionally, the CEC is building a $400 million state-funded Equitable Building Decarbonization (EBD) program direct install program.

Home Efficiency Rebate (HER)

The HER program is a $292 million efficiency rebate program. It is only for existing properties and the rebate is related to how much energy is saved based on either a calculated or measured approach. The rebate will cover 80% of project cost with a maximum $400,000 for multifamily properties. Eligible properties explicitly include housing owned by Public Housing Authorities, multifamily buildings receiving project-based rental assistance, and properties that use Low-Income Housing Tax Credits. Funding for this program is expected to start early 2025.

Home Electrification and Appliance Rebate (HEAR)

The HEAR program is a $290 million point-of-sale rebate. It is for both new construction and existing buildings. It covers up to 100% of the cost of eligible uses with a cap of $14,000 per unit. Eligibility is the same as the HER program above.

The table below summarizes the HER and HEAR funding. Additionally, the CEC has flexibility to broaden many requirements, including adding to the categorical eligibility list or increasing the cost caps per unit, or property. In terms of layering funding, these programs cannot be layered to fund the same upgrade, but they can be layered with other local, state, and utility programs. For the HEAR program, funding is expected to start August 2024.

Equitable Building Decarbonization (EBD) Program

In addition to the Inflation Reduction Act rebate programs, the CEC is building a $400 million direct install program where services and equipment are paid for as they are delivered by a third party contractor, as opposed to a rebate program where money comes in after the equipment is installed and inspected. EBD covers 100% of the cost of eligible uses. This includes heating, cooling, envelope, cooking, laundry, lighting, air quality, electrical wiring, and, in some cases, remediation.

Eligibility includes two different criteria. First, there is an income eligibility requirement where at least 66% of units must be affordable for households with incomes at or below 80% AMI. Secondly, there is community eligibility which include areas designated as a disadvantaged community and certain low-income census tracts. Once selected, administrators will identify initial focus areas to target based on need and impact on low-income households. The CEC expects to start making awards as soon as August 2024.

All told, the CEC is implementing three programs combining for over $1 billion toward decarbonizing our housing supply. However, as the Partnership has indicated to the CEC, having three separate programs makes it challenging for housing providers to apply. Thus, the CEC is working to streamline the funding sources as much as possible so that housing providers can access resources as straight forwardly as possible given the constraints of the state and federal funding programs. The Partnership continues to advocate on behalf of affordable housing providers on this point. If your organization has concerns or ideas, please contact adawson@chpc.net so that we can include them in our advocacy.

Renewable Energy Tax Credit Basics

Renewable Energy Tax Credits (i.e., Investment Tax Credits) were created in 2005 and renewed in 2022 with the passage of the Inflation Reduction Act (IRA) to provide financial incentives to businesses for developing solar PV, solar hot water, energy storage, and other eligible energy systems. Eligible businesses can claim this tax credit by completing and attaching IRS Form 3468 to a business’ tax return.

Renewable Energy Tax Credits Calculation

Renewable Energy Tax Credits (RETC) reduce a business’ federal income tax liability by a percentage of the cost of building an eligible energy system. RETC base credit rate is 30% for projects that begin construction before 1/1/2032 and meet certain labor standards or have a net output of less than one Megawatt. Projects that meet Domestic Content requirements, are located in Energy Communities, or serve Low-Income populations can increase their applicable RETC credit rate percentage up to 70% through credit rate bonuses.

Renewable Energy Tax Credit Calculation Example

An eligible $1,000,000 energy system would generate $300,000 in RETCs assuming a 30% base RETC rate.

An eligible $2,000,000 energy system would generate $1,400,000 in RETCs assuming a 70% RETC rate.

RETCs in Low Income Housing Tax Credit Context

Developers can pair RETC with Low Income Housing Tax Credits (LIHTC) to be purchased by an investor limited partner. RETC pricing is often similar to LIHTC pricing.

RETC no longer reduces LIHTC eligible basis. Eligible energy property basis (costs) can be used to generate both LIHTC and RETC.

Direct Pay / Transferability

The IRA created two new avenues to claim RETC:

Direct Pay: Allows government entities, nonprofits, and tribes that typically do not owe federal income tax to benefit from RETC by treating the amount of credits as a payment of tax and refunding any resulting overpayment.

Transferability: Allows entities not able to utilize Direct Pay (taxable entities) to transfer all or a portion of the RETC to a 3rd party buyer in exchange for cash

ABOUT THE AUTHORs

|

Ian Sharples supports the Partnership’s affordable housing preservation and policy work by advancing building decarbonization efforts. He leads the Partnership’s Building Initiative for Low-Emissions Development (BUILD) promotional programs and engagement on the Energy Efficiency for All (EEFA) advocacy campaign. He previously worked in Housing Services for Community Action Partnership of Kern and as Executive Director of the Income Property Association of Kern cultivating landlord engagement on homelessness. |

|

Andrew Dawson, Ph.D. interfaces with internal and external partners to inform the Partnership’s legislative and regulatory advocacy efforts and leads the policy work for sustainable housing. He previously worked in the Senate Housing Committee as as Science Technology Fellow thought the California Council on Science and Technology. His doctoral research focused on lithium-ion batteries and storage capacity expansion. |

|

Jesse Ozanian provides financial consulting, technical assistance, and training to our nonprofit and government partners. His work in the affordable housing field spans more than a decade. He previously worked in project management and development consulting at Mercy Housing and Zen Development Consultants, respectively, developing hundreds of affordable units across three states including California. |

Endnotes

1. Eligibility is focused on properties assisted under the Section 8 Project-Based Rental Assistance (PBRA) program, including properties that converted under the RAD Program prior to September 30, 2021; the Section 202 Housing for the Elderly program; the Section 811 Housing for Persons with Disabilities program; or the Section 236 program. For complete information on eligibility, please see the Notices of Funding Opportunity.

2. Taken from presentations by the Department of Energy’s Office of State and Community Energy Programs

3. The Senate Bill 535 Disadvantaged Communities Map developed under Health and Safety Code Section 39711 is available at https://oehha.ca.gov/calenviroscreen/sb535.

4. Projects must receive an allocation of a low-income population bonus through a competitive application process to take advantage of this bonus.

5. Certain tax structuring options must be implemented to claim RETC. Please consult with your financial advisor and/or tax professional to discuss the tax implications of claiming this credit.